Autonomous Vehicles represent a mobility game-changer

The promise of such vehicles is great – they could bring mobility to sections of the market that have never before had access such as children, the disabled, or those otherwise unable to drive themselves. In addition, they could enable new business models such as ride-hailing services using robotaxis, on-demand freight logistics services, mobile retail, in-car content provision, and servicing to be brought directly to the customer.

Challenges and roadblocks to full deployment are immense

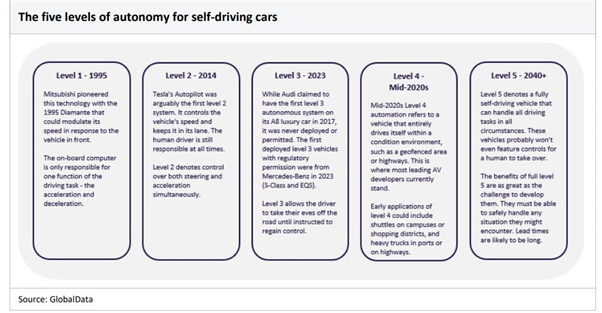

The difficultly of commercializing autonomous vehicles has proven equally great. For example, the leap taken from SAE Level 1 autonomy to Level 2 has proven to be minor compared with the jump in complexity needed for Level 3 ‘eyes-off’ AV operation. Moving to Level 4 from Level 3 will be a bigger jump still. Even Level 3 vehicles will appear simple in comparison with the higher levels and capabilities demanded by truly self-driving Level 4 and Level 5 models, both of which might not include controls for human drivers.

The Pandemic has slowed the progress of AV development

The post-COVID recovery period was dominated by a lack of supply of semiconductors. This has slowed progress in the development of autonomy.

The realization of the obstacles in creating fleets of autonomous vehicles has caused several exits from the race. Meanwhile, the technology, and regulatory environment are proving more difficult to implement than anticipated. Initially, there were lofty plans to soon launch robotaxi fleets, but this has now been replaced with a timeline with a significant delay.

Global AV sales of Level 4 and 5 in 2030 are now expected to number only 250,000 units. However, that is expected to rise to 4 million by 2040.

Leading companies

- AI software: A sizeable number of companies are developing AI for selfdriving cars using sensor-fed machine learning algorithms. The leader and closest to achieving Level 4 autonomy is Alphabet’s Waymo. OEM systems, notably Tesla but also Mercedes-Benz and those from Baidu, Aptiv, NVIDIA, and Intel/Mobileye, are all in contention. AI startups are innovating, including the US’s Aurora and China’s Horizon Robotics.

- AV hardware: Sensors provide the key data inputs to the car’s AI systems. A typical suite of sensors includes optical cameras, LiDAR, radar, ultrasonic receivers, and infrared sensors. Key players include Sony, Samsung Electronics, NXP, Infineon, ST Microelectronics, and Ouster (which acquired Velodyne). For LiDAR, leading player Ouster faces competition from Valeo, Innoviz, robosense, Quanergy, and Luminar. Nvidia is currently leading in important system-on-chip technology.

- AV-related services: The AV business models will create a range of new services. New AV fleet companies, led by the likes of Waymo, Cruise, Uber, and Didi, look set to lead. In addition, autonomous delivery and freight providers – from Uber Eats, Nuro, Aurora, and TuSimple – will begin to displace traditional planning for commercial and consumer applications. In-vehicle services will also expand, offering tech and media players new channels.

The basic technology and timelines

Level 1 semi-autonomous features first appeared in the early 1990s in the form of adaptive cruise control (ACC). It took another two decades for Level 2 systems to appear that could provide lane-centering capabilities alongside adaptive speed control – the two features taken together usually define Level 2 autonomy. While Audi claimed to have achieved Level 3 autonomy – defined as when the human driver may completely disengage from the dynamic driving task under certain conditions – with the A8 in 2017, it was unable to activate the feature because no market permitted cars to be driven without a fully attentive driver.

Mercedes-Benz became the first OEM to launch a Level 3 vehicle in late 2022 (both the S-Class and EQS models offered the features in geographies where regulation permitted, such as Germany).

Caption. Credit:

Progress, but also setbacks

2014 saw the first Level 2 autonomous vehicles hit the road, most notably Tesla’s Autopilot system. Despite CEO Elon Musk’s bold promises, Tesla has still not moved the system beyond its Level 2 billing, although it has added features that enable the car to complete a greater proportion of its journey on Autopilot. Crucially, Tesla drivers are still required to be in charge of the vehicle at all times and must intervene if something goes wrong. This has led to accusations that Tesla is being complacent with drivers’ safety because, inevitably, owners will use the system beyond its intended purpose, implicating Autopilot in a handful of fatal road accidents.

In August 2021, the US NHTSA formally announced it would investigate the circumstances of several serious accidents believed to have involved Autopilot.

It was expected that, with Audi’s 2017 announcement that it had installed Level 3 autonomous technology on the A8, and that Level 3 cars would be on the road at scale by the end of the decade. As Audi found, however, while the technology was becoming available, waiting for legislation to permit the use of such systems is another matter. This could not, therefore, be considered to be the arrival of Level 3 vehicles. It could be argued that Honda was the first automaker to finally get certification for a Level 3 system with its Japanese-market Legend luxury sedan (2021). This model offers a Traffic Jam Pilot, which can drive the vehicle through slow traffic without needing the driver’s attention. The conditions when this system could technically be seen to be Level 3 were, however, so limited that we do not believe this represented a true Level 3 launch either. What has been widely recognized as the first production vehicles at Level 3 are the late 2022 launches of the updated Mercedes-Benz S-Class and the EQS, including permissions to switch on the Level 3 functionality in Germany and several US states.

A substantial number of large companies, including both Ford and GM, had targeted large-scale deployment of Level 4 (likely shared) AVs by 2021. As that deadline approached, it became increasingly obvious that deployments would not happen on this timescale. Even now, with relatively frequent announcements of small-scale deployments of Level 4 shared AVs, is it clear that all companies involved are still firmly in the testing phase. The closest to achieving Level 4 autonomy is Google’s Waymo which has amassed tens of millions of miles of autonomous driving experience across its fleet, with vastly more achieved in simulations.

Waymo launched a limited commercial driverless service in Phoenix, Arizona at the end of 2018, with expansion taking place in December 2022 and May 2023 (using the Waymo One permitted driverless services). San Francisco is another of its primary locations for testing for both Waymo and Cruise. Until August 2023 both companies had significant restrictions on activity in the city: Waymo could charge in the neighbourhoods in which it operates, while Cruise was limited to evening/night operation.

These restrictions were removed by city policymakers, but the early days of more free operation have been rocky and there is a growing backlash against the decision (at the time of writing). These locations have been chosen by the AV developers because of their relatively low level of challenge. For example, Arizona tends to have clear, sunny weather and wide, simple road networks that suit current Level 4 systems. An incident in October 2023, involving a pedestrian hit by another vehicle into the path of a Cruise AV, led California’s Department of Motor Vehicles (DMV) to suspend Cruise’s licence to deploy driverless vehicles on the streets of San Francisco. As a result of this setback, Cruise has suspended its operations nationwide and recalled all 950 of its driverless vehicles to work on software updates.

Geofenced and campus environments

Before we see widespread adoption of Level 4 robotaxi networks, the technology is likely to find use in geofenced or campus environments, such as universities or large business parks. Alternatively, the same technology stacks are likely to be used to operate shuttle bus services between transport hubs, for example, between an airport and the city center. In addition, ports, mines, and other controlled areas may prove to be more expedient settings in which to deploy Level 4 technology because they see limited passing traffic, may not be subject to ‘normal’ road rules or other regulations, and automating processes there represents a clearer return on investment.