Coronavirus (COVID-19):

Sector Impact: Automotive – Global

Global light vehicle sales figures in January 2020 should make for alarming reading.

"At the first-ever Detroit auto show, Henry Ford said he was working on something that would strike like forked lightning," said Bill Ford, executive chairman, Ford Motor Company. "That was the Model T. Today, the Ford Motor Company is proud to unveil a car that strikes like forked lightning all over again. The all-new, all-electric Mustang Mach-E. It's fast. It's fun. It's freedom. For a new generation of Mustang owners."

Ford says it brought the Mustang Mach-E to life through a development process concentrated entirely on customer needs and desires. The result, it claims, is a sleek, beautiful SUV that delivers spirited ride and handling, with connected vehicle technology that makes Mach-E even better over time.

When it arrives in late 2020, Mustang Mach-E will be available with standard and extended-range battery options with either rear-wheel drive or all-wheel drive powered by permanent magnet motors. Equipped with an extended-range battery and rear-wheel drive, Mach-E has a targeted EPA-estimated range of at least 300 miles, Ford says. In extended-range all-wheel-drive configurations, Mach-E is targeting 332 horsepower and 417 lb.-ft. of torque – with the standard all-wheel-drive variation targeting quicker times to 60 mph than the base Porsche Macan series.

Ford also will offer two special performance versions. The GT is targeting 0-60 mph in under 4 seconds, making it faster off the line than a Porsche Macan Turbo3. The GT Performance Edition, meanwhile, is targeting a comparable 0-60 mph in the mid-3-second range to a Porsche 911 GTS.3 Both GT configurations are targeting an estimated 342 kW (459 horsepower) and 830 Nm (612 lb.-ft.) of torque.

Executive Summary

Sales outlook

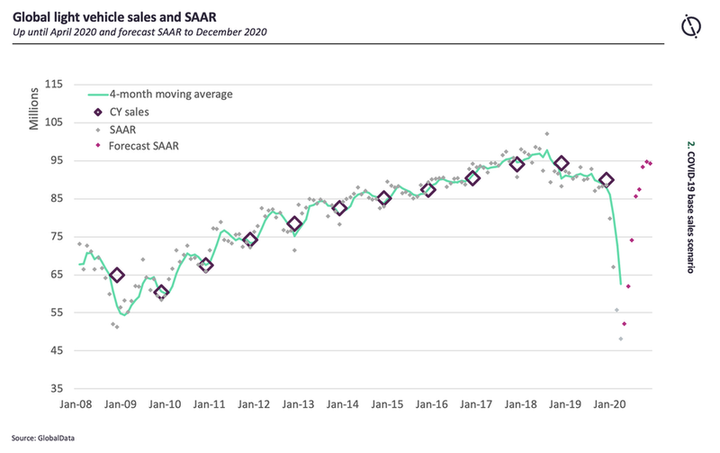

•Our base COVID-19 scenario now sees a 17.8% decline in sales in 2020 compared with 2019; a bigger one-off shock than witnessed in the two years of the global financial crisis

•Damage will be most acute in Q2, with a 40% drop in year-on-year sales forecast

•China’s April sales result may be instructive for other markets as its car sales bounced back by 4% year-on-year. However, a note of caution is due: the market’s at a very different motorization phase to the west and virus suppression has been much more effective than has been seen in some western countries

•For Europe, April light vehicle sales fell 75.6% - an accelerated rate compared to March’s 45.7% decline. For the year, we forecast a 23.6% decline in sales volume to 15.7m. This represents a marginal improvement on our last forecast due to many markets in May finishing ahead of our initial expectations

•In the US, May sales were again better than anticipated, with sales down 29.8%. For the full-year our base case sees a market down 14.4% to 14.6 million

Scrappage coming

•In Europe, France has announced a EUR8 billion stimulus for the automotive sector, with scrappage incentives heavily weighted towards EVs. The measures begin in June and should give the market a boost over the short- to medium-term.

•Germany has now committed to a scrappage incentive too, with a focus only on EVs

•In the Netherlands, a new incentive for EVs kicks off in July.

•Elsewhere discussions are ongoing between national governments and industry bodies: announcements as to market incentives in various markets are expected in the next few days and weeks.

•Any delays to the announcement of programs introduces more uncertainty. The introduction of schemes has been signaled widely so consumers will simply sit back and wait for the incentives to be introduced

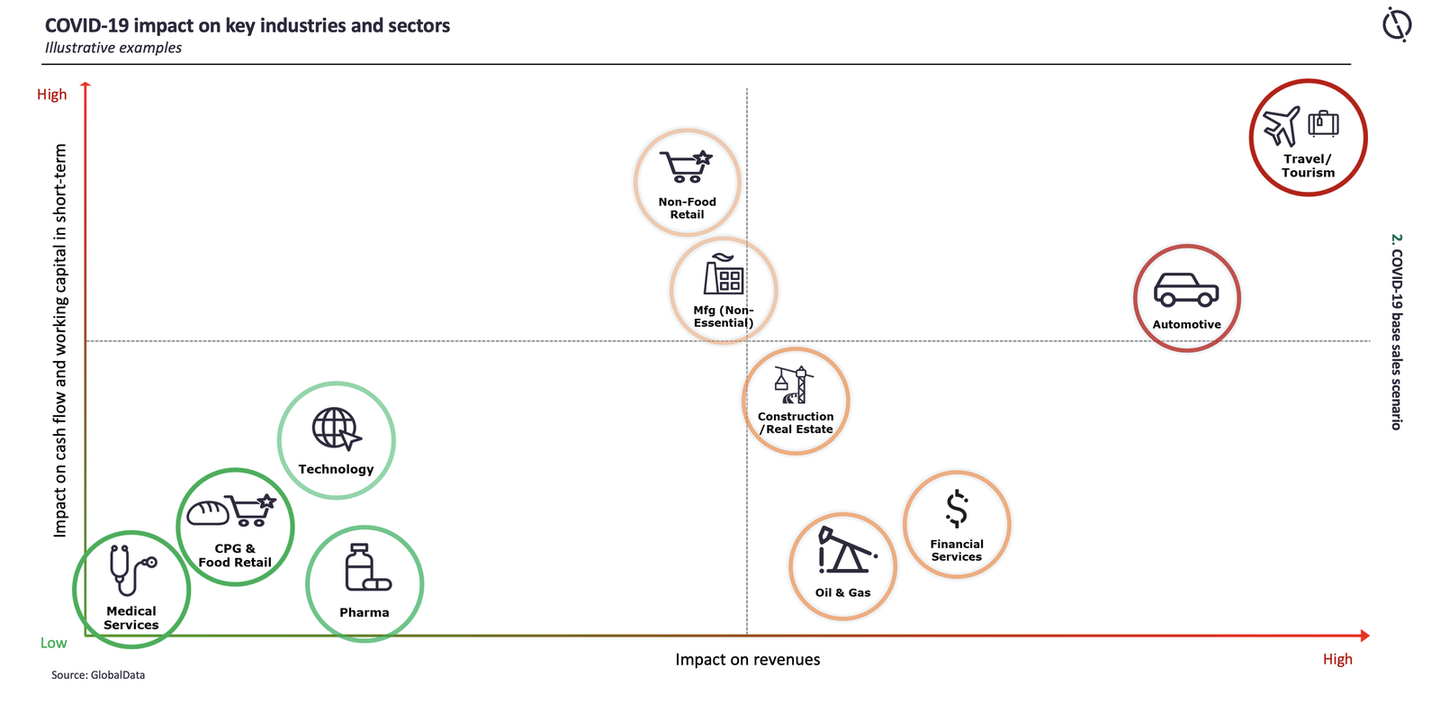

Impact across all industries varies, but automotive among the worst hit

Global light vehicle sales: market fell 47.5% in April and an historic low SAAR of 48.1 million was returned

April a write-off but will be the nadir globally

•Global light vehicle sales fell 47.5% in April to 3.8 million from 7.2 million a year ago, providing confirmation that COVID-19 really gripped economies outside of China in April.

•The worst affected regions were South America (-78%) and Europe (-75.6%). West Europe on its own fell 78.9%

•April’s results mean that YTD the global market is down a precipitous 32%, a decline nobody would have seen coming just four short months ago

•The SAAR dropped to 48.2 million for the month, below the previous low in our records of December 2008

•We believe that April will represent the low-point for the global market – other markets may reach their nadir in May or June – as China bounces back and other high volume markets begin to open the shutters

•Beginning now we’ll see if there’s pent-up demand in markets or if economic scarring will outweigh

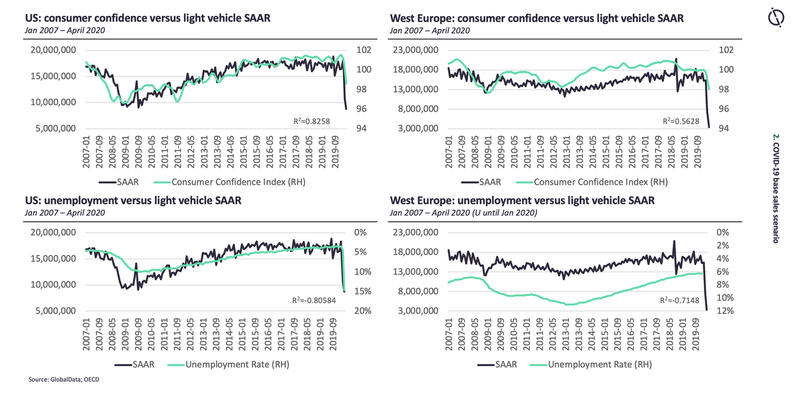

Plummeting consumer confidence and spiking unemployment a concern for market prognoses

Contact Us

For any questions or further enquiries please contact us at: covid@globaldata.com

Disclaimer

All Rights Reserved.

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, GlobalData.

The facts of this report are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that GlobalData delivers will be based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, GlobalData can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.