DEALS ANALYSIS

Deal activity trends down in most regions; Europe is top region by deals value so far this year

Powered by

Deals activity by geography

Deals activity is up in North America (+17%) and Europe (+9%), reflecting increased restructuring as the automotive supply chain emerges in bumpy fashion from the pandemic and its associated impacts on final goods supply and demand.

So far this year, North America leads on the volume of deals in the automotive sector, Europe leads on value.

Volatile business conditions and uncertain prospect across much of South and Central America explain lower deals activity there.

Deals activity by theme

| Deal type | Total deal value ($m) | Total deal count | YOY change (volume) |

| Acquisition | 831006 | 3682 | -74% |

| Partnership | 4319 | 1009 | 71129% |

| Asset transaction | 75028 | 930 | 235% |

| Equity offering | 67470 | 621 | 334% |

| Debt offering | 363602 | 618 | 144% |

| Private equity | 85438 | 580 | -58% |

| Venture financing | 12017 | 538 | 250% |

| Merger | 28159 | 68 | 1918% |

| Deal Type | 2020 (US$m) | 2021 (US$m YTD | 2020 volume | 2021 YTD Volume |

| Acquisition | 57,392 | 62,135 | 487 | 419 |

| Asset Transaction | 7,217 | 1,117 | 186 | 97 |

| Equity Offering | 77,565 | 41,517 | 311 | 154 |

| Partnership | 156 | 842 | 112 | 54 |

| Private Equity | 12,487 | 55,306 | 116 | 86 |

| Venture Finacing | 13,040 | 24,966 | 316 | 51 |

| Debt Offering | 111,229 | 35,849 | 205 | 98 |

| Merger | 2,179 | 14,089 | 40 | 28 |

Deals by sector

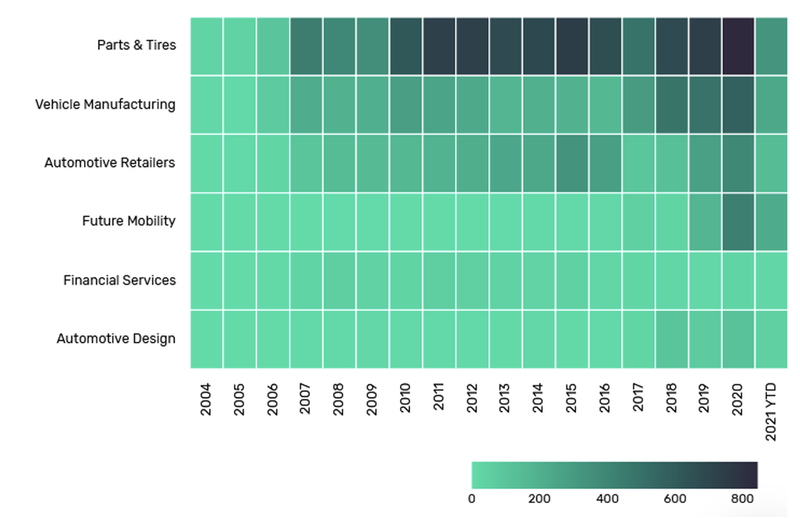

After a heavy skew towards activity in the supply chain (parts and tyres) in recent years, this year has seen a more equitable distribution across the major automotive sub-sectors. Future mobility remains strong.

Note: All numbers as of 8 September 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Automotive Intelligence Center

Latest deals in brief

Faurecia to acquire 60% of Hella

Faurecia is to acquire the 60% stake held by Hella pool shareholders, as well as launch a voluntary public tender offer to buy the remaining shares at an offer price of EUR60 per share. The closing of the transaction is subject to regulatory approvals and is expected in early 2022. The combination will create seventh largest global automotive supplier.

Qualcomm makes offer to buy Veoneer

Tech company Qualcomm has offered to acquire automotive supplier Veoneer at $37 per share in an all-cash transaction, surpassing Magna’s existing offer. Competition for Veoneer emphasises the value in ADAS technology providers and capabilities across the supply chain.

Renesas completes acquisition of Dialog Semiconductor

Renesas and Dialog Semiconductor have completed Renesas’ acquisition of the entire issued and to-be-issued share capital of Dialog. Renesas will fund the cash consideration payable to Dialog shareholders of around EUR 4.8bn (US$5.7bn) through a combination of debt, cash on hand and the proceeds of an equity offering of approximately JPY222.6bn.

Mazda to restructure China ops to form new JV

Mazda and its two Chinese partners are restructuring operations to form a new JV in which Mazda will hold a 47.5% stake. Chongqing Changan Automobile will also hold 47.5% of the new joint venture called Changan Mazda Automobile Co Ltd (CMA). FAW will own the remaining 5%.

Samsung to sell Renault-Samsung stake

Samsung had lofty ambitions for getting into the automotive industry as a big player in the early 1990s, but it ultimately failed. The divestment of the current stake in Renault-Samsung is a legacy loose-end being tied up. Samsung found other priorities (eg Harman).

Xiaomi targets autonomous driving with Deepmotion acquisition

Chinese smart-phone giant Xiaomi Corporation announced this week it plans to acquire local 3D imaging start-up Deepmotion in a deal worth over US$77m, as it looks to expand into the autonomous driving and connected technology sector.

Stellantis buying US auto finance company

Stellantis is buying a 'captive' auto finance company in the US. Stellantis said it had entered into a definitive agreement to acquire F1 Holdings, parent company of First Investors Financial Services Group, an independent auto finance company in the US, in an all cash transaction for around US$285m.